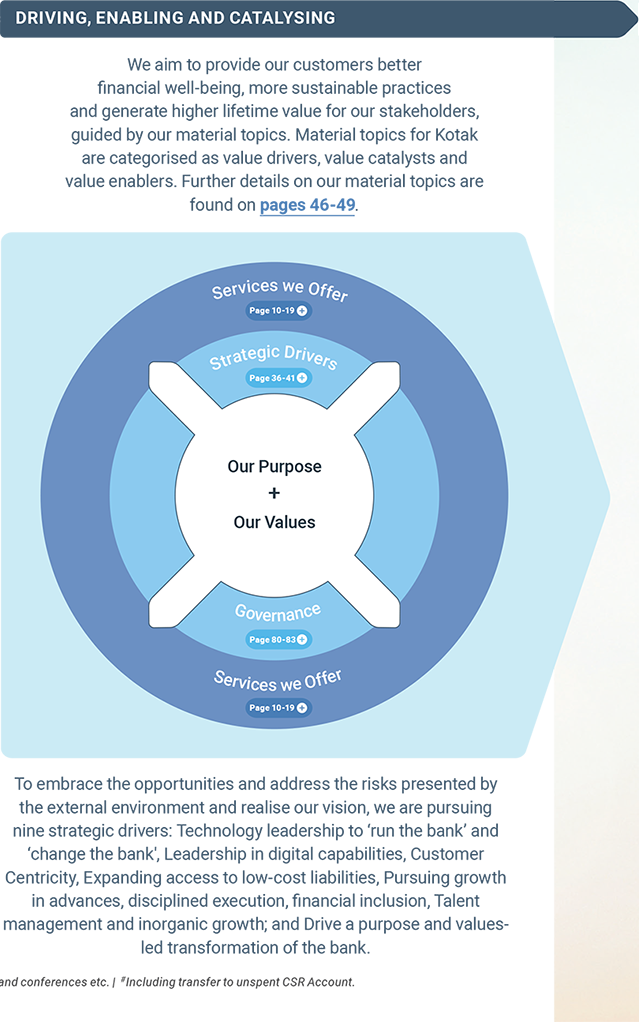

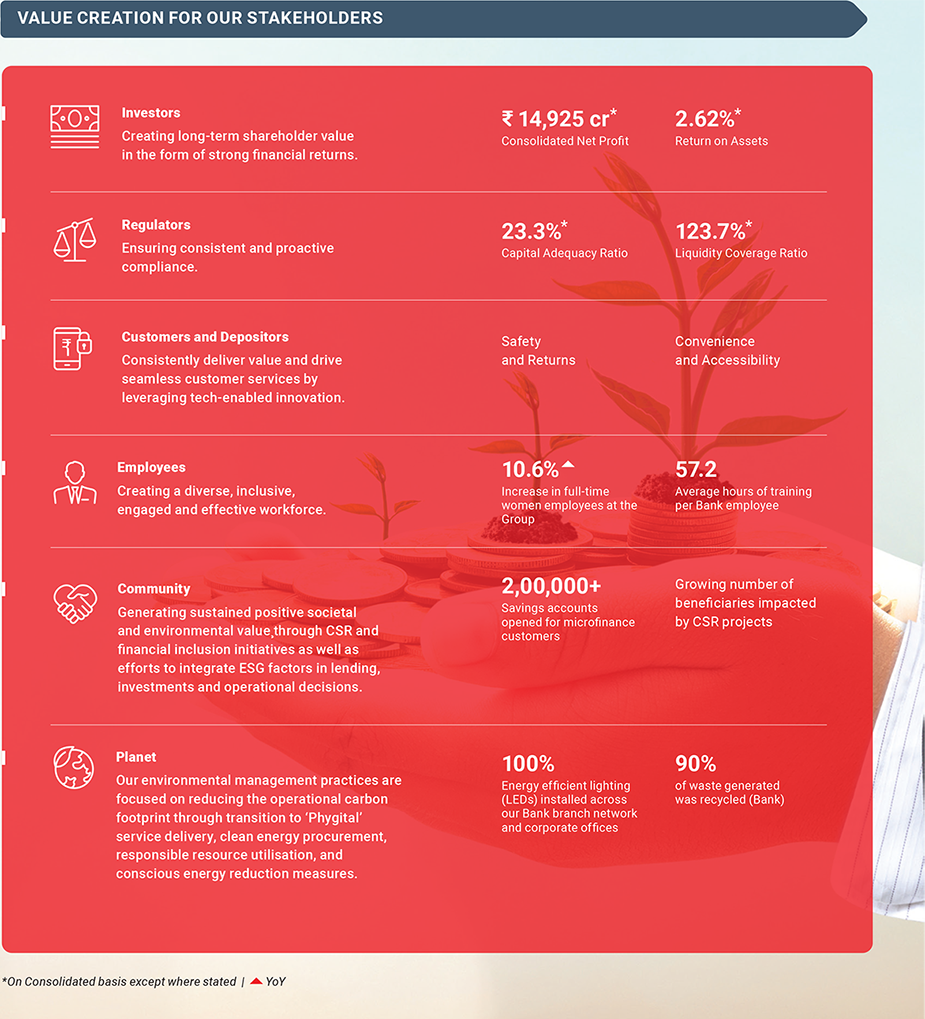

Technology at the Core: To ‘Run the Bank’ and ‘Change the Bank’

KPIs

Features

Biometric onboarding

DIY journeys

Auto service requests through

Keya - our customer service

chat-bot

Digital merchant ledgers

Multi lingual app for retail

microfinance customer

Open Banking Partners

YoY

Leadership in Digital

Capabilities

KPIs

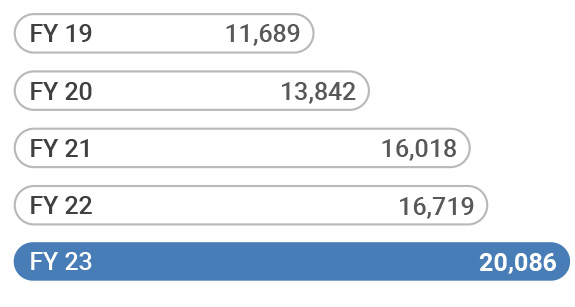

Growth in Kotak811

Savings Accounts

Increase in Mobile Banking 90-day active users

Savings account transaction volumes in digital or non-branch modes

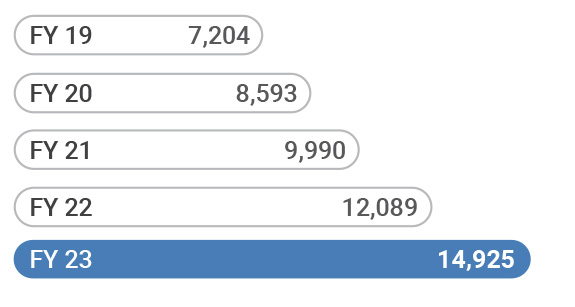

Growth in Mobile Banking transactions volume

Growth in UPI transaction volume from Kotak Mobile Banking app

Digital share of RDs opened

YoY | *March 2023 vs March 2022

Customer

Centricity

KPIs

Increase in Customer NPS

Increase in queries handled successfully by WhatsApp Banking

Increase in queries handled successfully by Keya Chatbot

Growth in Website service requests

^^Dec 2022 vs Jun 2022 | ^Q4FY23 vs Q4FY22 | YoY

Expanding Access

to Low-Cost Liabilities

KPIs

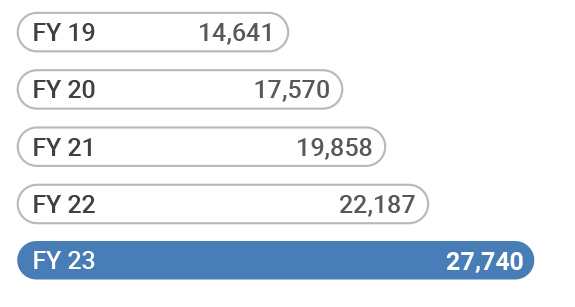

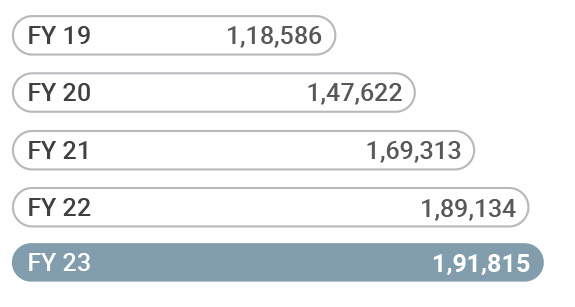

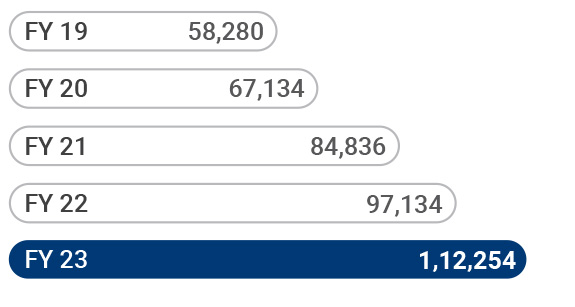

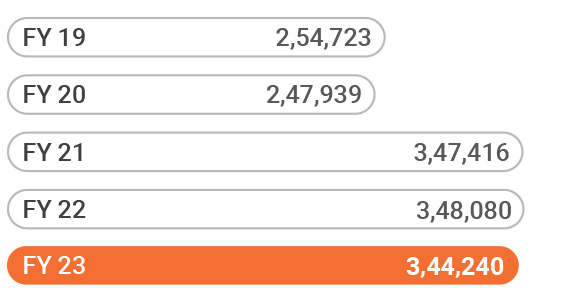

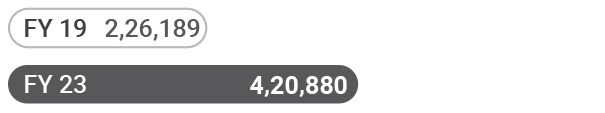

Growth in Bank's Customer Base

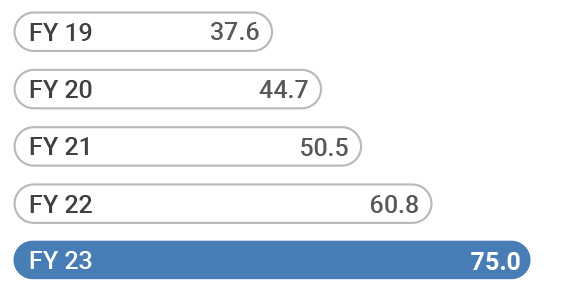

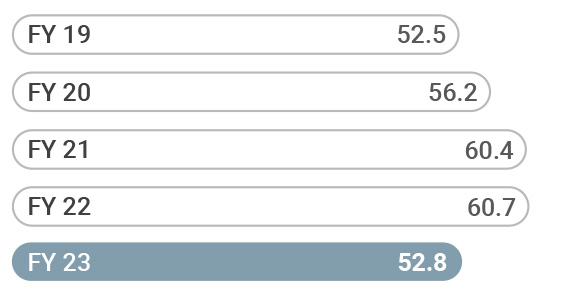

CASA Ratio

CASA and TDs below ₹ 5 cr as a percentage of Total Deposits

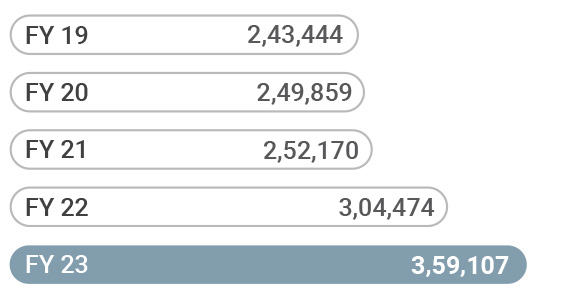

Growth in average CA deposits

^Q4FY23 vs Q4FY22 | YoY

Pursue Advances Growth, Ensuring Right Asset Quality Additions at Risk Adjusted Pricing and Appropriate Risk Management

KPIs

Growth in Credit Card advances book

Growth in Personal Loans, Business Loans and Consumer Durables advances

Unsecured Retail Advances (incl. retail microfinance) as a % of net advances vs 7% in FY22

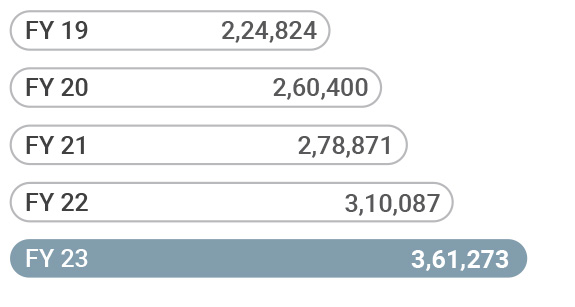

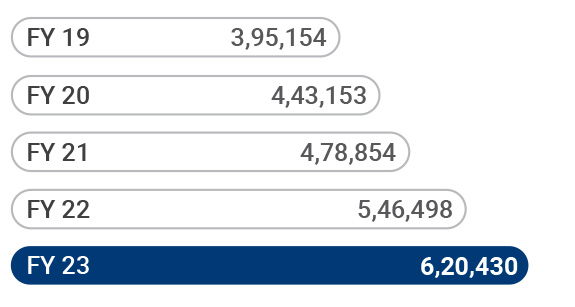

Growth in Bank's Net Advances

YoY

Executing with Discipline

and Improving Productivity

KPIs

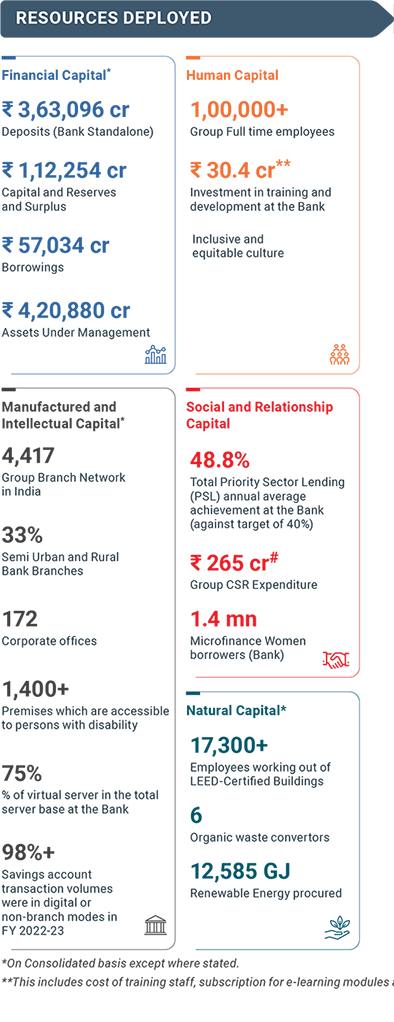

ROA

ROE

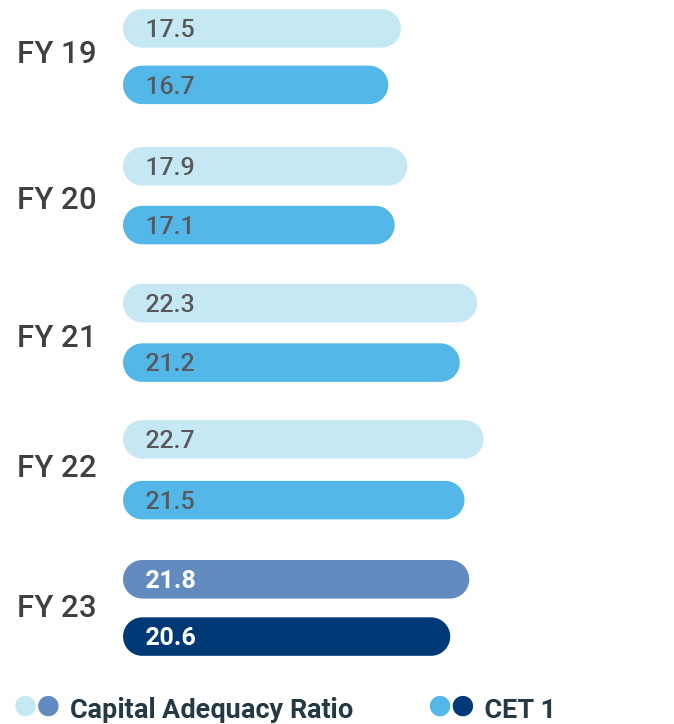

Capital Adequacy Ratio (CAR)

#On Consolidated basis

Know more

Approaching Financial Inclusion as an Opportunity

KPIs

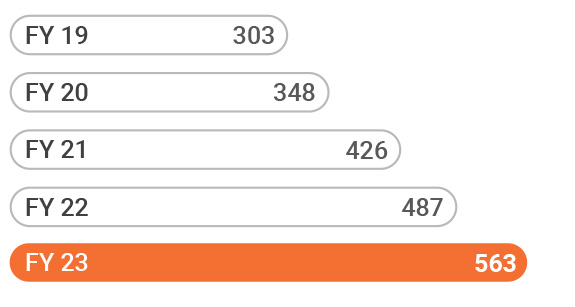

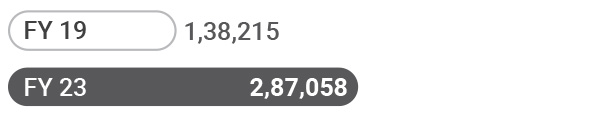

Growth in Underbanked Women Customers (Microfinance JLG customers)

Growth in Retail Microfinance advances

Growth in Organic PSL Advances of the Bank

Growth in Jan Dhan accounts opened

YoY

Attracting, Retaining and Building a Team of Talented, Engaged and Motivated Employees

KPIs

Score in Annual Employee Pulse Survey

Average tenure of the Kotak Leadership Team with the Group

Pursue Inorganic Growth -

Leverage Strong Standing

KPIs

Sonata Finance: Announced acquisition of 100% stake (subject to regulatory and other approvals) - a microfinance provider with presence in the northern states of India, which is complimentary to Bank's microfinance network

DLL Financial Services India: Acquired the agri and healthcare equipment portfolio with 25,000 high-quality customers