growth

Embracing the winds of change, Kotak has emerged as a transformative force within India’s financial landscape. Over the years, we have successfully navigated evolving market dynamics, consistently adapting offerings to meet the needs of a dynamic clientele. Powered by innovation and cutting-edge technology, we pioneer financial solutions, ushering in an era of convenience and empowerment. Further, we are embracing sustainability and ESG practices to drive transformative progress and create sustainable value for our stakeholders.

Kotak is one of India’s leading diversified and integrated financial services conglomerates, providing a wide range of financial solutions, covering banking (consumer, commercial and corporate), credit and financing, asset management, alternate assets, life and general insurance, stock broking, investment banking, private banking, microfinance and asset reconstruction across customer and geographic segments within India.

As a Group, Kotak also operates in overseas markets through international subsidiaries and branches in key geographies. In line with our relentless focus on customers, technology and talent, the Bank is accelerating change, thus driving sustainable growth across businesses and customer segments.

Kotak’s consolidated asset base stood at ₹ 6.2 trillion as of 31st March, 2023, with a market capitalisation of ₹ 3.4 trillion.1

KOTAK UNIVERSE^

Total assets

Assets under management

Total deposits

Total advances

Total investments

Shareholders base

Number of customers of the Bank

Full-time employees

Creating seamless customer experiences across platforms

DIGITAL ECOSYSTEM

We have designed our digital universe to complement our physical infrastructure and create a seamless experience between the two ecosystems, driving efficiency and enhancing customer experience.

Our services are available on various digital channels, such as websites, mobile apps, WhatsApp, chatbots, voice bots and kiosks. To provide ease of access, information and short videos are made available in English, Hindi and other vernacular languages. Bots are deployed to automate services, go paperless and deliver customer responses faster.

Digital universe

Debit cards in force

Credit cards in force

Growth in transaction volume on mobile app

Savings account transaction volumes were in digital or nonbranch modes in FY 2022-23

PHYSICAL FOOTPRINT2

Our pan-India distribution network comprising branches and franchisees enables us to reach out to a large customer base. We also have an international banking unit in Gujarat International Finance Tec-City (GIFT City), a bank branch in the Dubai International Financial Centre (DIFC), and international offices in New York, London, Mauritius, Dubai, Singapore and Abu Dhabi.

Bank branches

Bank pan-India operating locations

ATMs

Group branch network in India

Group Branch Network in India

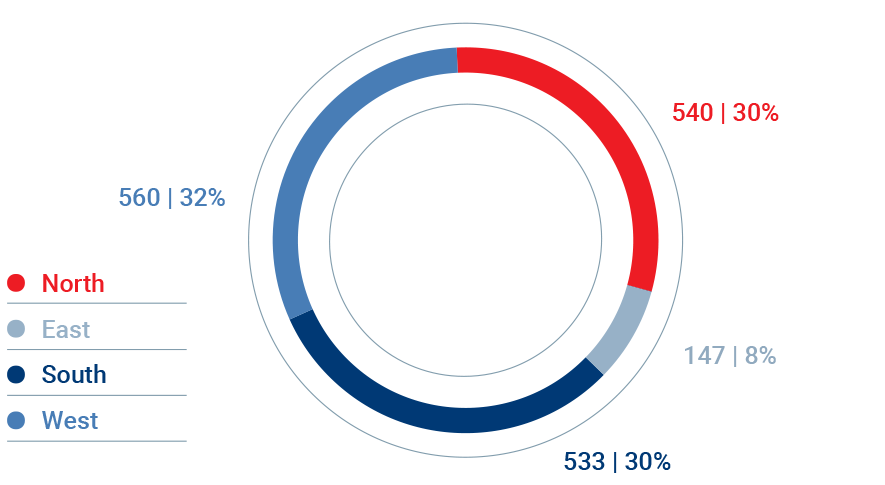

Bank branch distribution

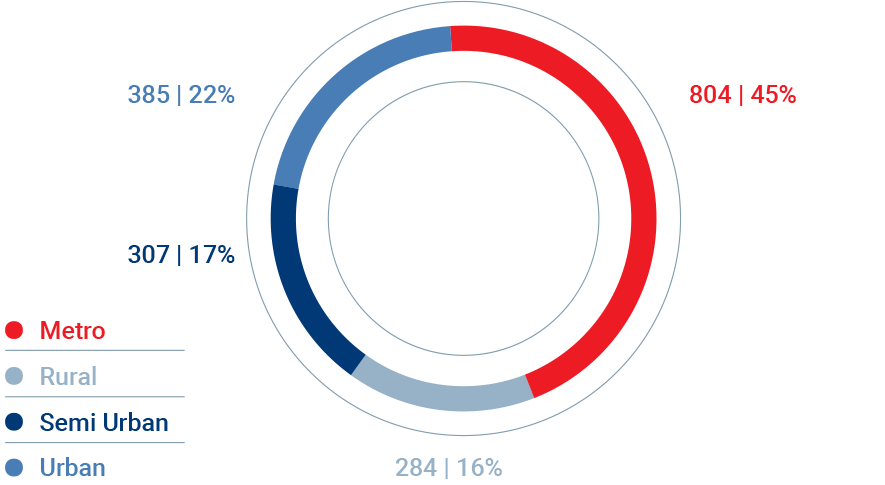

Bank branch classification

YoY | ^Does not include branches in GIFT City (Gujarat) and DIFC (Dubai) | ^^Including cash recyclers | #Kotak Securities network includes branches, franchisees and referral co-ordinators | 2GRI 102-4, GRI 102-6, GRI 102-7