Creation

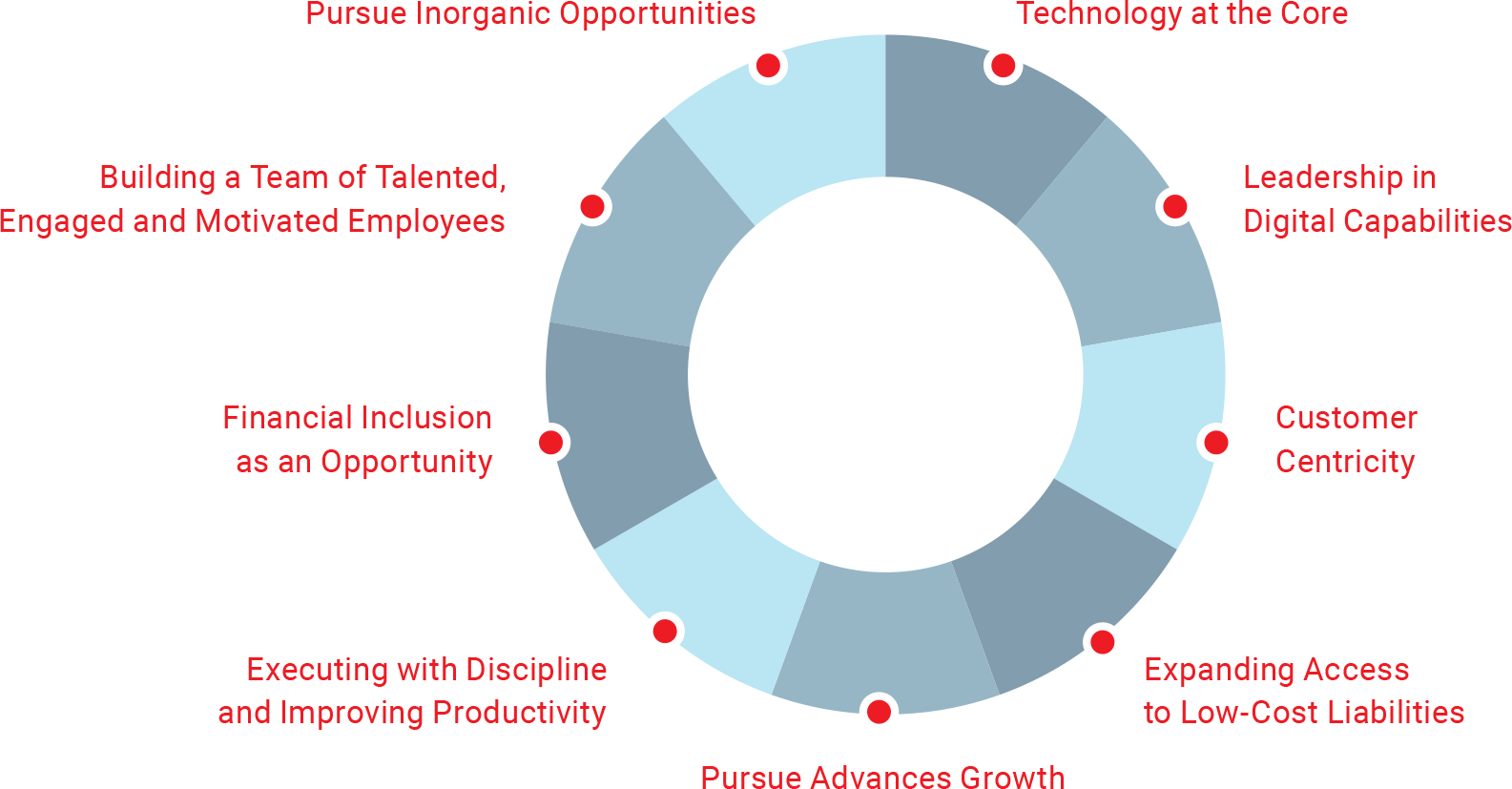

Our strategic drivers are dedicated to delivering the best possible experience for our customers and employees while also driving sustainable performance and delivering long-term shareholder value.

As customers increasingly utilise digital channels to engage and transact with us, we consistently augment our digital capabilities, including the mobile suite, self-service options and digital-driven processes, to provide a multitude of opportunities for our customers to bank conveniently at their fingertips. We also work on blending talent with tools and technology to enable a more productive, informed and empowered employee ecosystem.

Our initiatives to be future-ready are underpinned by our time-tested values of customer centricity, managing risk, strong governance and community engagement. Our strategic drivers are dedicated to delivering the best possible experience for our customers and employees while also driving sustainable performance and delivering long-term shareholder value.

STRATEGIC DRIVERS

Technology at the Core

Technology at the Core: To ‘Run

the Bank’ and ‘Change the Bank’

SDG linkage#

Relevant material topics

Enhancing customer experience

Data security

Customer data privacy

We aim to be at the forefront of new-age technology initiatives to drive customer experience through superior products and solutions. Through investments in technology, we are creating a strong back end that enables resilience, scalability and agility in operations.

Coupled with various front-end development initiatives, this translates to an enhanced experience for customers and employees through automation, platform convergence, cyber security, regulatory compliance and decision-making analytics to create a future-ready digital-first Bank.

KPIs

Features

- Biometric onboarding

- DIY journeys

- Auto service requests through Keya - our customer service chat-bot

- Digital merchant ledgers

- Multi lingual app for retail microfinance customers

Open Banking Partners

#SDG - Sustainable Development Goals | YoY

Leadership in Digital Capabilities

Leadership in Digital

Capabilities

SDG linkage

Relevant material topics

Enhancing customer experience

Promoting financial inclusion

Minimising environmental impact of operations

Our digital strategy is focused on serving the entire lifecycle of the customer including acquisition, engagement and experience. With our robust digital acquisition engine and advanced analytics capabilities, we can effectively harness the cross-selling potential of a wider customer base. We are investing to create tech-driven simplified digital journeys across products such as Home Loans (HL), Personal Loans (PL) and Credit Cards (CC).

Kotak811, India’s first downloadable digital bank account developed completely in-house has morphed into a semi-autonomous digital bank within Kotak. Its contribution towards Bank's Deposits, PL disbursements and CC is expected to keep growing with revamped customer digital journeys and experiences.

Kotak Mobile Banking app continues to get enhanced and empowered, providing a feature-rich portfolio of 265+ services, enabling us to engage and service our customers anytime, anywhere.

A digital backbone also enables us to partner with business correspondents and new-age Fintechs for wider distribution and to create unique offerings for our customers.

KPIs

Growth in Kotak811

Savings Accounts

Increase in Mobile Banking 90-day active users

Savings account transaction volumes in digital or non-branch modes

Growth in Mobile Banking transactions volume

Growth in UPI transaction volume from Kotak Mobile Banking app

Digital share of RDs opened

Digital share of FDs opened

Digital share of Investment accounts opened

Growth in volume of digitally sourced Credit Cards

Growth in value of digitally sourced Personal Loans

Of customer requests serviced digitally

YoY | *March 2023 vs March 2022

Customer Centricity

Customer

Centricity

SDG linkage

Relevant material topics

Enhancing customer experience

Customer data privacy

Ethical business processes

We believe that the convenience of the digital banking experience and trust through branch presence is among the most important factors influencing customers’ choice of banks. This ‘Phygital’ proposition helps us expand our reach while enabling multi-modal customer engagement and service delivery.

The use of advanced analytics helps us anticipate customer requirements and engage them with the most suitable offerings. We also constantly broaden our product portfolio to create customized products that appeal to specific customer segments. Some notable initiatives include Kotak Crème, Everyday Savings accounts, Silk, Co-branded credit cards with PVR, Indian Oil, Metro Cash & Carry, and Merchant-focused Current account—Merchant One.

We aim to surpass customer expectations by adding a delightful experience layer across all customer touchpoints through advancements in digital journeys across products to create a seamless 'self-serving' banking experience at the click of a button. We also track the 'Net Promoter Score' on a regular basis and use it for understanding customer delight, loyalty and satisfaction levels with the Bank.

KPIs

Increase in Customer NPS

Increase in queries handled successfully by WhatsApp Banking

Increase in queries handled successfully by Keya Chatbot

Growth in Website service requests

^^Dec 2022 vs Jun 2022 | ^Q4FY23 vs Q4FY22 | YoY

Expanding Access to Low-Cost Liabilities

Expanding Access

to Low-Cost Liabilities

SDG linkage

Relevant material topics

Enhancing customer experience

Brand and reputation

We continue our focus on retail banking business by growing our physical branch-led distribution and augmenting our digital acquisition through 811.

Our ability to cover all customer segments through a wide array of products, solutions, superior transaction and service experiences, enables us to create a granular current, savings and term deposit base. Being highly customer centric, we constantly revamp our product portfolio to fulfil all customer needs helping us become a primary bank for the customer and enhancing our product penetration across our retail customers, merchants, Small and Medium Enterprises (SME) and corporates.

KPIs

Growth in Bank's Customer Base

CASA Ratio

CASA and TDs below ₹ 5 cr as a percentage of Total Deposits

Growth in average CA deposits

^Q4FY23 vs Q4FY22 | YoY

Pursue Advances Growth, Ensuring Right Asset Quality Additions at Risk

Adjusted Pricing and Appropriate Risk Management

Pursue Advances Growth, Ensuring Right Asset Quality Additions at Risk Adjusted Pricing and Appropriate Risk Management

SDG linkage

Relevant material topics

Financing with a focus on environmental sustainability

Promoting financial inclusion

Minimising risk impact of climate change due to investments/advances

We continue to target a prudent balance between unsecured and secured advances with a focus on risk-adjusted returns. Advanced Analytics has enabled us to assess customers’ needs, propensity for leverage and risk profiles which are critical drivers for the digital distribution of credit products such as credit cards and personal loans. The ability to instantly fulfil credit needs creates the necessary leverage to scale such assets at an optimal cost of acquisition.

In addition, the augmentation of product, process and risk-based pricing capabilities has driven growth in our secured retail, business banking and corporate portfolios. Besides the consumer and corporate portfolios, the bank continues to have strong growth in Commercial lending including Tractor financing, Commercial vehicles, Retail MFI, and SME segments by focusing on new products, customer segments and geographies.

The Bank has commenced evaluation of ESG as one of the metrics while assessing credit and portfolio risk and it aims to expand the scope of such ESG evaluations.

KPIs

Growth in Credit Card advances book

Growth in Personal Loans, Business Loans and Consumer Durables advances

Unsecured Retail Advances (incl. retail microfinance) as a % of net advances vs 7% in FY22

Growth in Bank's Net Advances

YoY

Executing with Discipline and Improving Productivity

Executing with Discipline

and Improving Productivity

SDG linkage

Relevant material topics

Enhancing customer experience

Corporate governance

Ethical business processes

We continue to leverage technology for scalability while also ensuring time and cost- efficient operations. We have revamped our internal processes to enable the customer to Do-It-Yourself (DIY) in addition to empowering our workforce with tech-enabled tools and processes to service our growing customer base, improving productivity and efficiency

IWe have embraced open banking and modernized our technology infrastructure to improve analytics, underwriting processes and risk management systems, driving efficiency. We maintain high capital adequacy and track the risk in our asset portfolio judiciously, helping us maintain our earnings potential sustainably and navigate uncertainties in the external environment.

KPIs

ROA

ROE

Capital Adequacy Ratio (CAR)

#On Consolidated basis

Approaching Financial Inclusion as an Opportunity

Approaching Financial Inclusion

as an Opportunity

SDG linkage

Relevant material topics

Promoting financial inclusion

Community well-being

Regulatory compliance

Our digital focus has enabled us to serve under-banked customers efficiently. We have a fast-growing retail microfinance franchise, with over 1 million women customers that has helped bring several underbanked segments into the financial ecosystem. We continue to focus on expanding this franchise into new geographies.

We continue to widen our base of savings accounts to lower income groups and extend government-sponsored lending/insurance schemes and Aadhaar-Enabled Payment Systems through our digital, branch and Business correspondent network to these segments. Our focus is to convert these activities into sustainable opportunities on their own in the long run.

KPIs

Growth in Underbanked Women Customers (Microfinance JLG customers)

Growth in Retail Microfinance advances

Growth in Organic PSL Advances of the Bank

Growth in Jan Dhan accounts opened

Building a Team of Talented, Engaged and Motivated Employees

Attracting, Retaining and Building a Team of

Talented, Engaged and Motivated Employees

SDG linkage

Relevant material topics

Promoting employee health, safety and well-being

Enabling learning, development and an open work culture for employees

Promoting diversity, equity, and inclusion among employees

Talent is a key contributor to our performance. We continue to invest in and develop tech-based internal tools for improving the productivity of our people. Learning A-Fair, our organisation-wide e-learning initiative with around 90 sessions, helps us drive learning on various themes such as technology and digital, leadership, soft skills, customer-centricity etc. In addition, we focus on ongoing training and upskilling programmes for our employees at various stages in their careers.

We have launched multiple health and lifestyle initiatives, specifically to improve our employees’ well-being. We also have structured career development programmes to help identify future leaders and fast-track their career growth. Our focus on employee well-being, flatter organisational structures and diversity will ensure an engaged and productive workforce.

KPIs

Score in Annual Employee Pulse Survey

Average tenure of the Kotak Leadership Team with the Group

Certified as a ‘Great Place to Work’ again by the Great Place to Work® Institute for two years in a row

Bank's Learning A-Fair Platform won Gold for Best Advance in Unique Learning Technology at the Brandon Hall Technology Excellence Awards 2022

YoY

Pursue Inorganic Opportunities

Pursue Inorganic Growth -

Leverage Strong Standing

SDG linkage

Relevant material topics

Brand and reputation

We are continuously evaluating acquisition and strategic investment opportunities in order to expand our market share, improve our value proposition and capabilities, or expand into new geographies.

KPIs

Sonata Finance: Announced acquisition of 100% stake (subject to regulatory and other approvals) - a microfinance provider with presence in the northern states of India, which is complimentary to Bank's microfinance network

DLL Financial Services India: Acquired the agri and healthcare equipment portfolio with 25,000 high-quality customers