Prowess

To stay ahead of the accelerated shift in the delivery model to digital, we undertook several initiatives aimed at enhancing customer delight and convenience by creating hassle-free, user-friendly journeys for existing and new-to-bank customers. The investments we made in transformation projects, and in up-fronting technology spends towards strengthening our core, are leading to new age of digital banking and experiences for its customers.

Kotak Mahindra Bank

CONSUMER BANKING

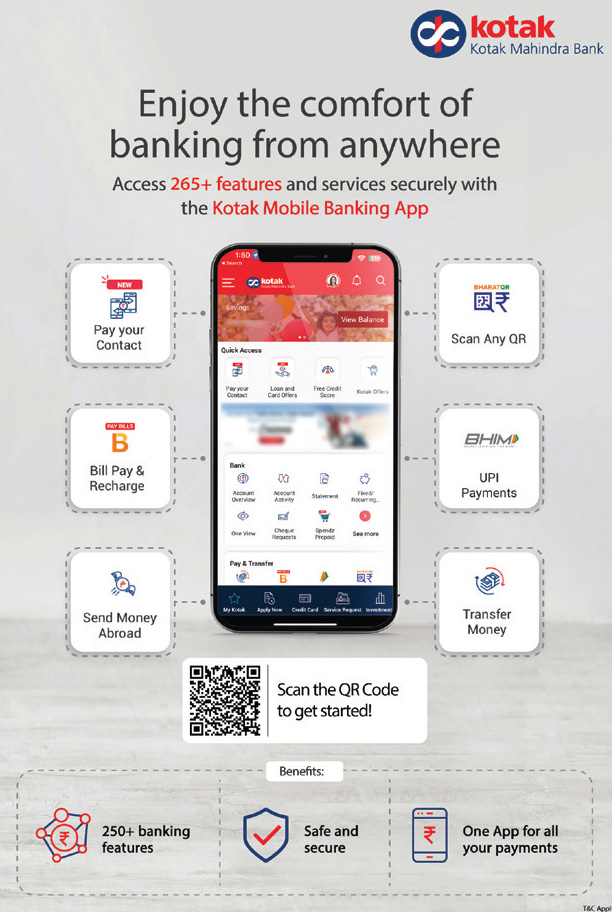

Mobile Banking: Super App For All Financial Needs

Offers a feature-rich mobile banking experience with 265+ features live. The App continues to be among the top-rated banking apps on both iOS and Android platforms. We augmented its versatility and enhanced the customer experience by adding new services such as UPI number-based money transfer, real-time status check of UPI transactions, a revamped journey for FD/RD, one view of the net worth, RM eKonnect (direct connect with RMs over app), InstaSIP, App access for forex-only customers, accessing wealth portfolios by private banking customers and facilitating tracking of credit card spends. New-to-bank customers were enabled to avail products such as 811 account, credit cards and home loans directly via the mobile app. Customers can now raise service requests for loans and track these requests on the app (45+ services).

Increase in 90 days Active Users

Growth in Transaction Volume

Net Banking

We added journeys such as downloading the GST Summary, Tax Invoice and Interest Certificate to the website. Based on consumer feedback, we redesigned the deposit section, improving the UI/UX for creating FDs, RDs and Tax-Saver Deposits. We enhanced the service request section by adding NRI services, ReKYC, tracking of outward cheques, management of transaction alerts, personalised offers widget and RM eKonnect service.

We have implemented Behavioural Biometrics on Net Banking and Payment Gateway as advanced security feature.

Growth in Non-financial Transaction Volume

Growth in Financial Transaction Value

*March 2023 vs March 2022 | YoY

Kotak.com

For Personal Loan customers, journeys were improved to check their Loan Application status online, access Repayment Schedule, Statement of Account, etc. More than 90% of personal loans (by volume) are serviced end-to-end digitally.

We have implemented Behavioural Biometrics on Net Banking and Payment Gateway as advanced security feature.

Growth in Organic Traffic

Improvement in Product sales leads

Increase in total Pre-login service requests on the website

Conversational Banking

Keya and WhatsApp have become the most interactive and secured service centres for Kotak customers with over 60 live enquiries and services. Customers can enable/disable credit card controls, download tax certificates for their home loans on Keya. WhatsApp had a complete revamp, enhanced UI, Next Best Actions and opening-up to NR customers. We also added Google Business Messages (GBM) Chatbot as another conversational banking channel.

Increase in queries handled successfully by Keya Chatbot

Increase in queries handled successfully by WhatsApp Banking

Digital Payments

We have enabled ‘UPI Lite’ as remitter, ‘Send money to UPI number’ and ‘Unified Dispute and Issue Resolution (UDIR)’ journey for customers to check the transaction status and raise complaints from our mobile app.

Growth in in-app UPI Transaction volume

Growth in UPI transaction volume on Bank acquired merchants

YoY | ^Q4FY23 vs Q4FY22

Account Aggregator and Open Banking (API)

The Bank joined the Account Aggregator (AA) ecosystem to empower customers to control access to their data. AA ecosystem data will be utilised in lending and Personal Finance Manager (PFM) journey.

We are live on 360+ API (both public and private) on the API platform and live with 115+ partners (increased by 2.2X YoY).

DIY on-boarding journeys for

- New-to-Bank Credit Card customers with real-time checks like PAN, Aadhaar, 26AS, Video KYC, Instant card generation.

- Personal loans are available in just a 3-clicks journey for our existing customers and a simple 3-step journey for our new-to-bank customers.

- Home Loan available to new-to-bank and existing customers. Also launched new Loan Origination System (LOS) to reduce the turnaround time from login to disbursement for all customers.

- Savings account for an easy and quick way to open an account with zero paperwork and documentation.

Growth in volume of digitally sourced Credit Cards

Growth in value of digitally sourced Personal Loans

Business Banking Assets

Partnership with Actyv.ai

Integrated an end-to-end digital supply-chain finance journey for distributors and retailers buying from OEMs (Original Equipment Manufacturers) on B2B platforms such as Actyv.ai.

OCEN

Collateral-free real-time working capital finance to MSMEs registered on the Government’s e-Marketplace (GeM) Sahay platform as sellers against purchase orders. It’s an end-to-end digital journey.

Digi OD Renewal

Fully digital OD facility without any collateral for Kotak current account holders has been further enhanced with the digitalisation of the renewal of the OD facility. The limits that are already appraised and sanctioned as per normal course shall be renewed in this completely digital journey.

Funds against credit card receivables (Insta POS Prime)

Launched digital loans against card/UPI/QR receivables for merchants using Kotak POS terminals available through multiple digital modes and voice/SMS platforms, including kotak.biz payment app for merchants.

Wholesale Banking

Scalability

- We have enabled all forms of tax payments for our customers by directly integrating with the central tax platform.

- Our enterprise payments platform has now achieved 7X speed on transactions processed per second, offering seamless experience to our customers.

- Enabled UPI acceptance at 1000 TPS through best-in-class enterprise architecture with asynchronous settlement, thus reducing per-second transaction TAT.

Payment Space

- We have strengthened our BBPS (Bharat Bill Payment System) proposition, to a near-100% success rate by enhancing platform features. We also completed the UPMS certification with NPCI, and enabled credit card payments as a new category under BBPS.

- The Bank’s NACH backend platform was optimised with end-to-end automated solutions such as vendor module and initial rejection in physical and e-sign mandates. We also launched E-Nach variant (based on Aadhaar OTP) and increased the online direct debit limits to ₹ 50 lakh.

Increase in transaction volume under BBPS

Increase in E-Nach mandates

Life Insurance (Kotak Life Insurance)

- Launched DIY (Do-It-Yourself) journeys on KLI Website, Bank mobile and net banking for key savings and protection products.

- Launched KGSO, a few click insurance purchase journey enabled on Kotak Bank mobile app. KGSO, is a low-ticket group affinity product that covered 85,000+ members during FY 2022-23.

- Launched Express Claims Portal (for faster and paperless claim processing in the Group business), thus enabling 61% claims processing in T+1 days.

- Daily commissions were enabled for policies sourced with digital payments^.

- 61% of ‘non-medical policies’ were issued in T+1 days through the rapid issuance process, up from 40% in FY 2021-22.

(78%) Customer Service transactions processed digitally

Of Policies* were sourced through online platforms and Genie app

General Insurance (Kotak General Insurance)

- Launched QR Code-based customer journeys for our microfinance partners for easy on-boarding.

- Launched ‘GIA’, an AI-based virtual assistant for easy query resolution and servicing.

- Implemented CLOOTRACK, a digital insights platform to drive, track and measure customer experience across internal and external touchpoints.

Automation for Policy Issuance was achieved

Growth in D2C (direct-to-customer) business

Mutual Fund (Kotak Mutual Fund)

- Continued to enhance the distributor transaction platform, 'Kotak Business Hub', with 27,000+ distributors.

- Launched a digital campaign, ‘#AapBasELSSKaro’, to educate investors on the dual benefits of investment in Tax Saver Funds, i.e., Tax Saving and Growth Potential.

Growth in Investor base through the website

Growth in Assets Under Management (AUM) through website

Growth in Systematic Investment Plan (SIP) through website/p>

YoY | ^subject to capping of ₹ 25,000, where the payment is done fortnightly | *Individual policies (non-rural)

Strengths

Accelerating our core technology backbone and complementing it with our mindset change as we pivot to building a powerhouse of software engineers, software product managers and technical programme managers building new in-house platforms to enhance customer experiences and outcomes.

Customer Service Efficacy and Unified Onboarding Journeys for Customers

Salesforce, which was implemented (and went live) for customer servicing through branches and call centres, has improved productivity for our end-users. This success has enabled us to accelerate the replacement of many of our legacy systems with the latest technologies.

Data Analytics

CONSUMER BANKING

We have strengthened our application of predictive science using advanced machine learning across the customer lifecycle, specifically in the areas of customer acquisition, service and cross-selling. In lending, this has helped us with the precise application of risk-based pricing and deepening customer engagement. We have also modernised our advanced analytics stack through the addition of cloudbased solutions, resulting in enhanced scalability, speed and precision of data-backed business decisions

We have launched initiatives in customer and marketing analytics using customer behaviour data to design innovative products and services, which, in turn, has helped us increase financial inclusion. We used advanced deep-learning applications for Speech-to-Text conversions, leading to a better understanding of customer interactions and subsequent service. We have also introduced straight-through interactive journeys via WhatsApp, which has helped us significantly in driving deposit and lending growth.

COMMERCIAL BANKING

The extensive utilisation of data analytics has helped the collections team prioritise high-risk accounts. We achieved this by predicting future defaults by analysing the repayment behaviour and historical delinquencies of customers. Data-led acquisitions based on deep data mining and propensity models have gained momentum, contributing to a noticeable boost in fresh acquisitions across most businesses.

WHOLESALE BANKING

Data and analytics applications focussed on increasing productivity and adding to the bottom line. We implemented new-age analytics tools, such as graph data and big data, to yield substantial business growth opportunities. We have identified and converted opportunities in deepening the cross-selling, acquisition across the supply chain using graph data science and transaction analytics.

Architecture and Infrastructure

Established joint prioritisation across business and IT on the resiliency of the core systems. A near-DR site was established for core systems for better resiliency and performance. Proactive upgrades to systems nearing their end of life were also undertaken.

Risk and Cyber Security

Established joint prioritisation across business and IT on IT risk and security metrics. Successfully completed weekday BCP runs for all core platforms. Implemented best practices on cyber security monitoring and analysis.

Achieved Card Security Standard (PCIDSS) certification, underscoring our commitment to ensure the highest level of security for cardholder data and reinforcing our position as a trusted and reliable financial institution for its customers. We also implemented DevSecOps practices for our critical home-grown applications to enhance software security and deliver more robust and secure solutions.