Gaining Leadership

in Green Energy

Tata Power is at the forefront of the transition towards green energy. As one of India’s largest integrated power companies, we have gained a leadership position in the sector. It aligns with the country’s ambition of being net zero by 2070 and demonstrates our future readiness aided by the adoption of technology and the development of innovative business models.

Energising Transformation for Our Stakeholders

KNOW MOREA Year of High-powered Growth

1.03

Net debt to equity

2.66

Net debt to underlying EBITDA

BB+/ Stable

S&P Global rating upgraded

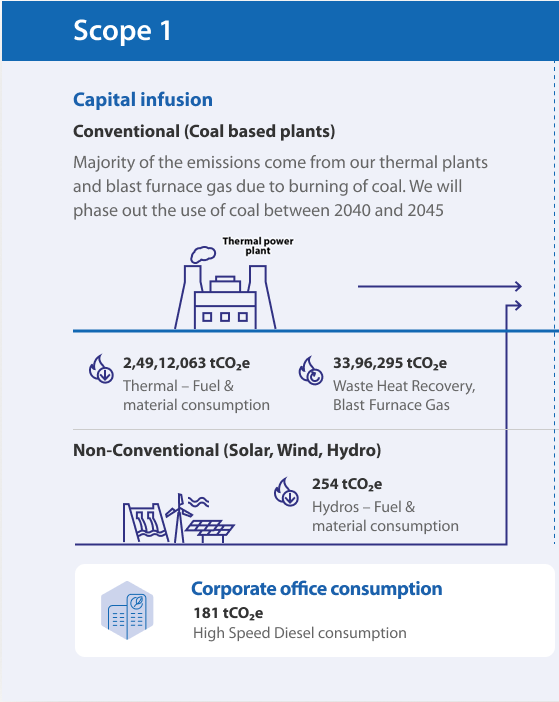

Capital infusion

` 4,000 crore capital infusion into renewable business by external investors- BlackRock and Mubadala

New acquisitions

Completed acquisition of NRSS XXXVI Transmission Limited (NRSS) and South East UP Power Transmission Company Limited (SEUPPTCL)

54,052 MUs

Total power generation

595 MW

Clean and green capacity commissioned

4+ GW

Utility-scale Solar EPC order book

12.9 million

Customers served

4.6 GW

Manufacturing capacity of solar cells and modules including under construction

3,700+

Public EV charging points energised

37%

Clean and green portfolio

13.8%

RE procured by Mumbai and Delhi Discoms

4.5 million

Trees planted

7%

Carbon intensity reduction

6.7+ lakh

Total employee training hours

` 50 crore

CSR Spend

` 56,033 crore

Revenue

32%

` 10,068 crore

EBITDA

23%

` 3,810 crore

PAT

77%

9.3%

RoCE

(FY22 - 7.8%)

12.6%

RoE

(FY22 - 9.5%)

` 2

Dividend declared per share

(FY22 - ` 1.75)

Decarbonising

for Tomorrow

Spearheading decarbonisation through innovative and proactive initiatives.

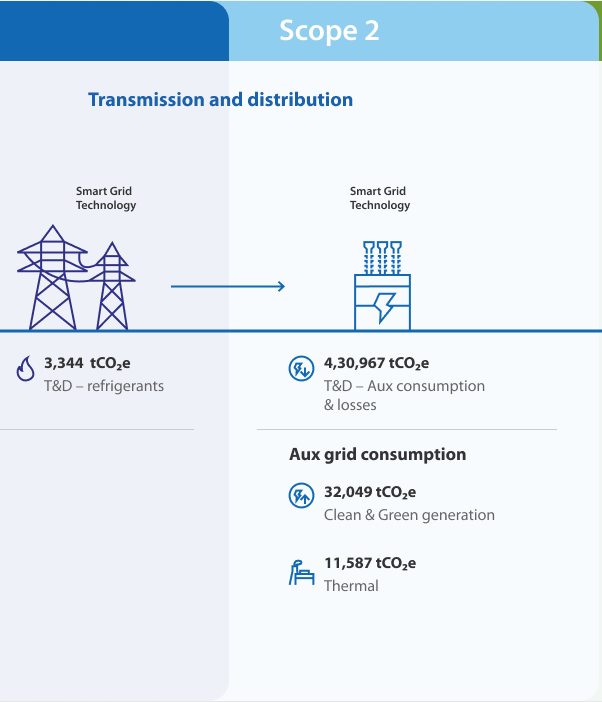

Decarbonising Across the Value Chain

KNOW MOREWe recognise that achieving genuine decarbonisation requires addressing the entire value chain, encompassing both upstream and downstream sectors.

Empowering

for a Green Future

Our renewables business has expanded significantly across EPC, utility-scale, and rooftop, solidifying our leadership further. Our leadership in the EV charging space was further strengthened with a network of 3,700+ public and captive EV charging points energised across 351 cities and towns.

DR. PRAVEER SINHA CEO & MD, The Tata Power Company Limited

KNOW MORE MEET THE BOARDDecarbonisation Roadmap

We are dedicated towards achieving a sustainable and green future for India. We have pledged to achieve 100% generation through clean and green portfolio before 2045, by prioritising universal energy access, energy efficiency, breakthrough clean technologies, and electric mobility.

KNOW MORE

Our ESG

Commitments

We have established a strong sustainability governance framework to guide, execute, and oversee sustainability-focused decisions and actions.

KNOW MOREStrategy to Drive The Clusters

Our four key business clusters are propelled by the opportunities, strategy, and enablers aligned to the evolving market context, ensuring profitable and sustained growth.

Sustainable Is Attainable

In partnership with News18 Network, we have launched an initiative to fast-track India's green-energy transition.

The objective of the campaign is to spread and promote the use of eco-friendly and clean energy in India, making it possible for millions of Indians to achieve a sustainable lifestyle by adopting green products and solutions.

Sustainable

Strategy in Action

Delivering Value

Empowering and guiding stakeholders to collectively create value for all.

Stakeholders' Focus and Issues of Significance

A crucial step in creating value is preserving and strengthening stakeholder trust, which calls for transparent and responsive stakeholder engagement.

KNOW MORE