Investors

Investors

- Scheduled investor/analyst meets

- Quarterly results call

- Organising Investor Roadshows

- Participation in events/conferences

- Once annually based on investor needs

- Once every quarter

- 1-2 times every quarter

- 3-4 times every quarter

Social And Relationship Capital

Financial capital

Strategic Business Objectives

Key Risk

Investors

Our business thrives on the unwavering trust bestowed upon us by our investors. We are committed to being accountable for meeting and surpassing their expectations, and we achieve this through a relentless pursuit of operational excellence, strengthening of our balance sheet and efficient capital allocation that supports capital expenditure projects and new business ventures.

We have established targets that are designed to foster sustainable growth in the future and guarantee our position as market leaders. Through this strategic approach, we are in a favourable position to evolve into a comprehensive Utility of the Future.

MARKET LEADER IN EV CHARGING

MARKET LEADER IN ROOFTOP

DELIVERING SUSTAINABLE SOLUTIONS

EXPLORING OPPORTUNITIES UNDER PPA/DELICENSING

FOCUSED GROWTH IN TRANSMISSION

- Stringent targets for reducing carbon intensity

- Emphasis on viable technologies

- Storage technology: hydrogen

- Carbon capture and mitigation

Through our business endeavours, we have consistently generated enduring and sustainable value for our stakeholders, which remains fundamental to our Business Philosophy. Our strategy for continued success revolves around placing a high priority on operational excellence, maintaining a robust financial position and effectively allocating capital resources.

We highly value the strong relationship we have cultivated with our investors, one that is rooted in mutual understanding and our unwavering dedication to delivering value to them. We prioritise transparency in our disclosures and uphold regular and open lines of communication with our investors. We firmly believe that there are four crucial pillars that underpin the creation of value for our investors.

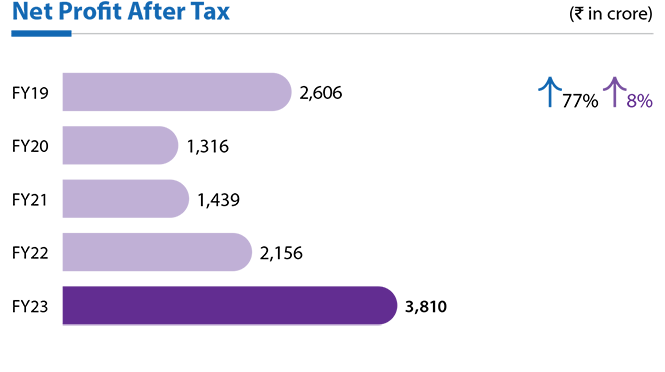

Providing strong earnings growth

Announced plans to increase revenues by 3x and profits by 4x in next 5 years

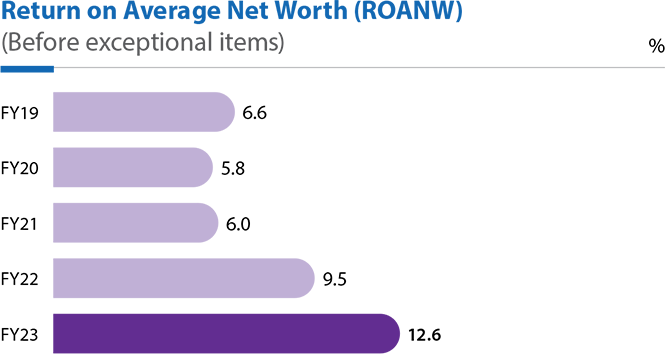

Improving RoE

Growth accompanied by improved returns for the shareholders. We are targeting to reach Return On Equity (ROE) >12%

Maintaining strong balance sheet

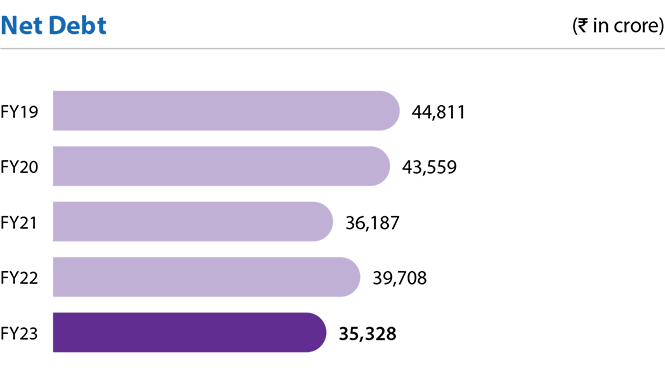

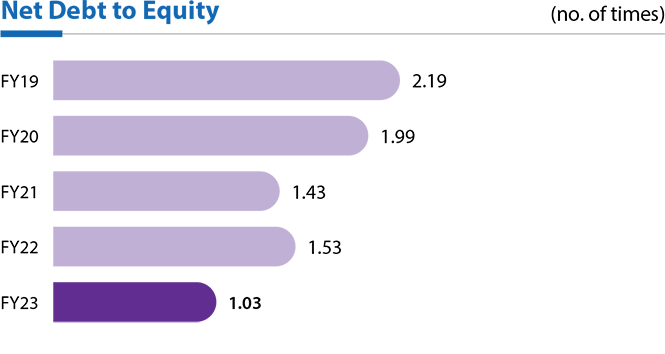

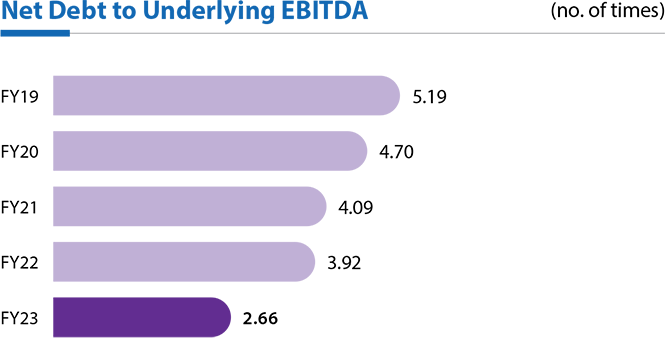

We endeavour to achieve strong growth without compromising our balance sheet strength, by maintaining healthy leverage ratios, including net debt/underlying EBITDA below 3.5 and net debt/equity below 1.5

Focus on business sustainability

Sustainability is at the heart of our business decisions. Our long-term targets to become carbon net zero before 2045 and water neutral before 2030 are aligned to this philosophy

Tata Power emerged as the top-ranking power utility in the country by scoring 67 points in S&P Rating, with 85 percentile. Tata Power has been winning the award from ICAI Award for Excellence in Financial Reporting for the past three years.

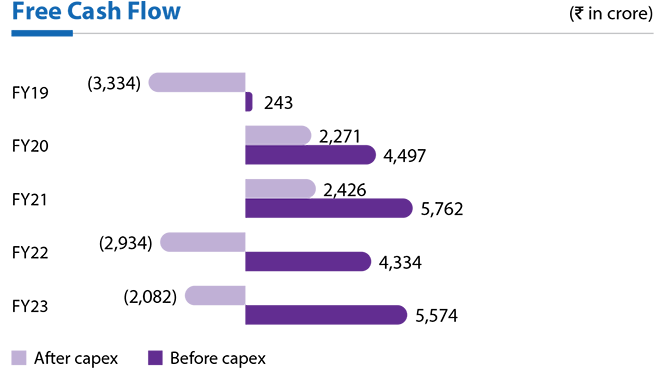

We are on a growth trajectory that requires continual investments for projects and ventures, in addition to maintaining optimal operational performance. Our financial capital is powered by a mix of debt and equity sources, apart from our rising cashflows and accruals. As part of our strategy, we are according an undeterred focus on maintaining a strong balance sheet and improving our return profile while targeting growth.

We are strategically positioned to drive long-term shareholder returns by capitalising on significant market potential and emerging prospects. Our focus on renewable energy has led to exponential growth in that sector, aligning with promising opportunities. We are undergoing a transformation to prioritise our brand and customer-centric approach. Our plans include expanding our distribution network throughout India, utilising technology to expand rooftop solar initiatives, and developing innovative, low-carbon solutions such as ESCO, home automation, and EV charging. These efforts firmly establish us as one of the leading energy companies in India.

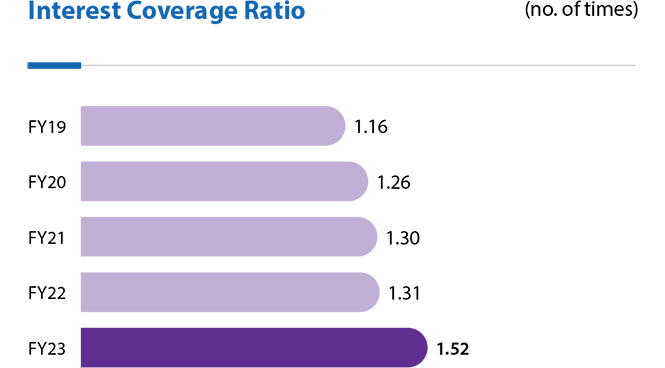

It has been a constant endeavour by our Company to improve our balance sheet position significantly. In FY23, we have been able to maintain a sustainable debt profile, led by robust cash flows from operations, equity contribution from strategic partners, measured approach to capital expenditure as well as proceeds from the divestment of non-core assets. Tata Power’s net debt/ underlying EBITDA has improved to 2.66 in FY23 from 3.92 in FY22 on a consolidated level, reinforcing the Company’s commitment to maintaining a comfortable debt position for sustainable growth.

Debt reduction

- Improved focus on collection from customers. Favourable legal orders in Andhra Pradesh, government notification on EMI payment for outstanding dues and increased engagement with Discoms ensured the liquidation of receivables

- Working capital management through supplier credit and other trade finance structures ensured credit terms were enhanced

- Divestment of stake in the renewable-energy business and higher dividend from coal SPVs on account of higher international coal prices

Key ratios

Notes

- Return on Average Net Worth (ROANW) before exceptional items % = PAT before exceptional items/Average Equity

- Return on Average Net Capital Employed (RoACE) before exceptional items % = NOPAT/Average Capital employed

- Capital employed = Total Equity + Total Net Debt + lease liability

- NOPAT = PAT before exceptional items + finance cost- other income- tax shield on net finance cost

- Net Debt to Equity = Net Debt/Equity

Net Debt = Total Debt - cash & cash equivalents - other bank balance - current investment - loan from related party - Net Debt to Reported EBITDA = Net Debt/Earnings before Interest, Tax, Depreciation & Amortisation

- Net Debt to Underlying EBITDA = Net Debt/ Earnings before Interest, Tax, Depreciation & Amortisation + Share of profit from JV & Associates

- Interest Coverage Ratio = Earnings before Interest and tax/Finance cost

Credit Rating

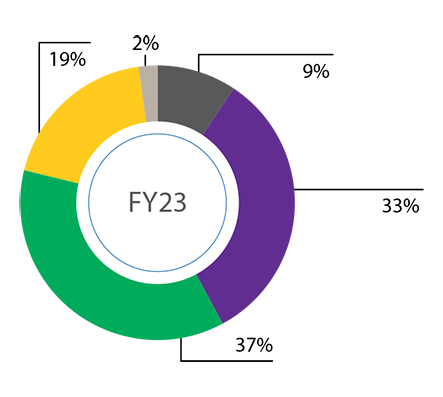

Strategic Shift in Capital Employed

We are strategically redirecting our capital from traditional Mundra and thermal operations to businesses that prioritise cleaner and consumer-driven solutions. This reallocation reflects our commitment to sustainability and meeting the evolving needs of our customers.

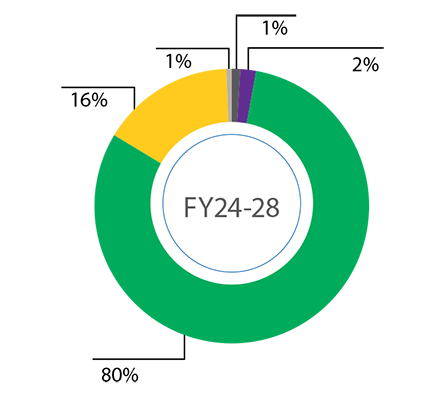

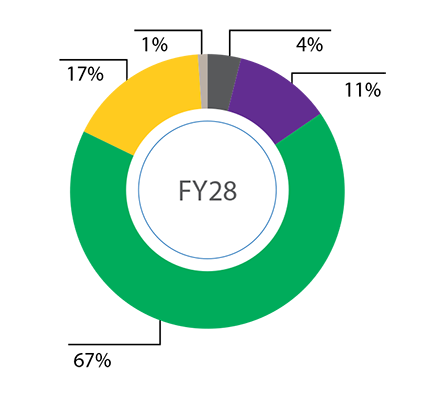

Reallocation of capital employed

Capital Employed (%)

5-year Capex Mix (%)

Capital Employed (%)

Performance in FY23

Note: The Management Discussion and Analysis” section on page 192 details more on financial performance of the Company

Free cash flow = Cash from operating activity + dividend income – dividend paid – distribution on unsecured perpetual securities – interest paid - capex

(` in crore)

| Particulars | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Revenue generated1 | 30,370 | 29,510 | 33,679 | 43,496 | 57,471 |

| Economic value distributed | 30,592 | 29,110 | 33,322 | 43,336 | 56,608 |

| Operating costs2 | 24,151 | 22,352 | 26,090 | 34,780 | 47,173 |

| Employee wages and benefits | 1,339 | 1,441 | 2,317 | 3,612 | 3,624 |

| Payments to providers of financial capital3 | 4,557 | 4,674 | 4,429 | 4,214 | 4,895 |

| Payments to government by country4 | 506 | 609 | 447 | 695 | 871 |

| Community investments-CSR | 39 | 34 | 39 | 35* | 45* |

| Economic value retained = Direct economic value generated less economic value distributed | (222) | 400 | 357 | 160 | 863 |

Notes:

- Revenue generated including other income and movement in regulatory deferral balance

- Operating cost including Cost of power purchased, Cost of Fuel, Transmission charges, Raw material consumed, Purchase of finished goods, increase/decrease in WIP, depreciation & other expenses excluding CSR

- Payment to providers of capital includes finance cost paid, dividend paid to shareholders & Distribution on Unsecured Perpetual Securities.

- Payments to government by country include income tax paid (net of refund received)

* CSR includes both spent and unspent amounts