Empowering Life,

Driven by Values

At SBI Life, we have embarked on a transformative journey over the past two decades, emerging as a trusted and preferred life insurance provider in India. In our journey, we have always remained committed to our core values of Integrity, Humility, Transparency, Innovation & Sustainability, while empowering lives of our stakeholders.

Highlights FY23

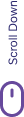

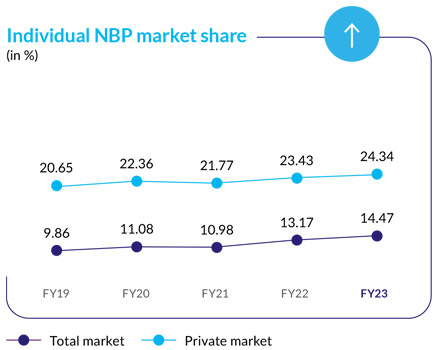

Rank 1

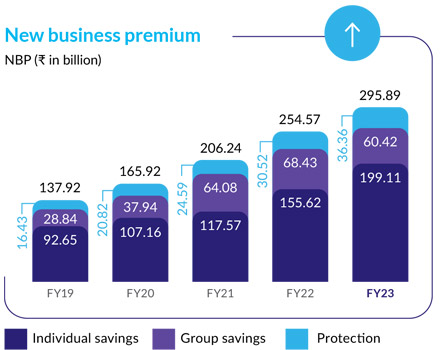

among private players in New Business Premium (NBP), Individual NBP and Individual Rated NBP

Lowest

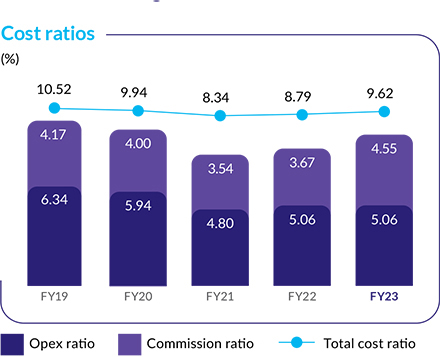

Operating expense ratio

16%

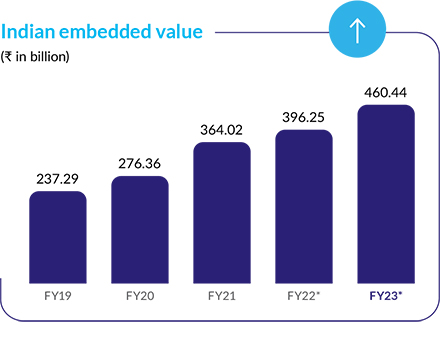

Indian Embedded Value (Y-o-Y) growth

15%

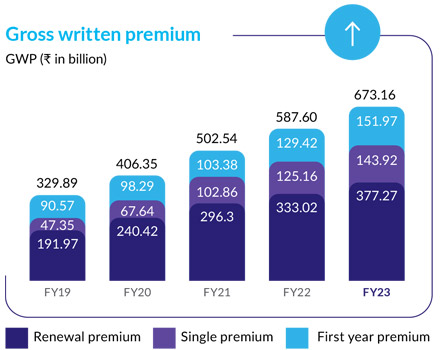

Gross Written Premium (Y-o-Y) growth

16%

NBP (Y-o-Y) growth

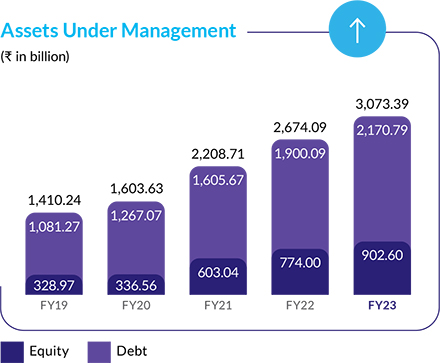

Crossed Asset Under Management mark of

`3 trillion

14%

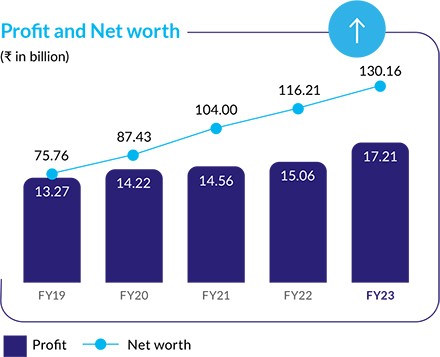

Profit After Tax (Y-o-Y) growth

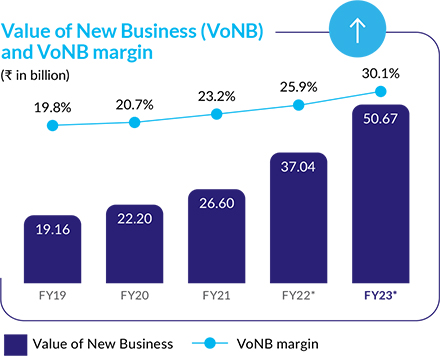

37%

Value of New Business (Y-o-Y) growth

12%

Networth (Y-o-Y) growth

420 bps

Increase in VoNB Margin

99%

New business proposal sourced digitally

86.7 tCO2e

Scope 1 Emission

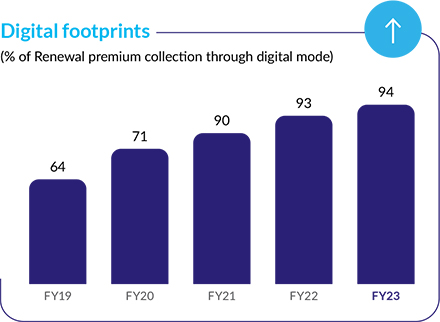

94%

Renewal collection through digital mode

4,902.2 tCO2e

Scope 2 Emission

5 new products

launched

59

Net Promoter Score

89%

Renewal collection efficiency

20,787

Total employees

26%

Increase in women employees

992

Offices

2.8 lakhs

No. of business partners

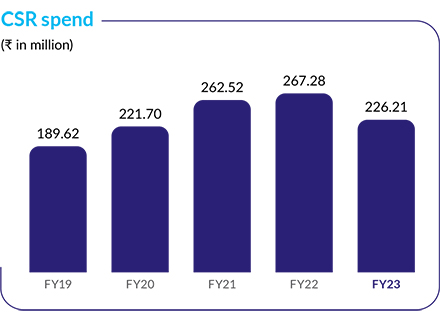

`226.2 mn

CSR spent

Empowering life of

our stakeholders

Customers

Material issues

- Customer Service and Satisfaction

- Purposeful Products and Services

- Brand and Reputation Management

- Cyber Security and Customer Privacy

Strategic Objective

- Customer engagement with enhanced experience

- Expanding digital footprints for seamless journey

Focus areas

- Customer centric approach

- Fostering customer engagement

- Increasing customer retention

- Enhancing customer experience

- Prioritising customer satisfaction

Key highlights

` 364.08 bn

Individual Renewal Premium collected during FY23, 13% growth over FY22

` 305.24 bn

Claims/Benefits paid to more than 27 lakh policyholders/claimants/ beneficiaries during FY23

People

Material issues

- Employee Centricity

- Human Rights

Strategic Objective

- Building skilled and dynamic team

- Expanding digital footprints for seamless journey

Focus areas

- Diversity and inclusion

- Employee engagement and recognition

- Employee health and well-being

- Learning and development

Key highlights

20,787

Total employees

19.04%

Women employees

Business Partners

Material issues

- Sustainable Supply Chain and Partnerships

- Brand and Reputation Management

Strategic Objective

- Robust distribution model with expanded reach

- Expanding digital footprints for seamless journey

Focus areas

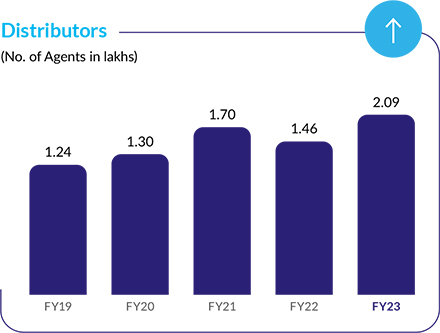

- Establishing a robust distributor ecosystem

- Partnering to expand distribution network

- Fostering distributor engagement

- Harnessing the power of digital technology

Key highlights

40

New offices added in FY23

~75,500

Gross Additions of Agents in FY23

Shareholders

Material issues

- Regulatory and Legal Compliance

- Governance and Ethical Business Practices

- Risk Management

Strategic Objective

- Sustainable growth with value creation

- Expanding digital footprints for seamless journey

Focus areas

- Focus on VoNB growth and profitability

- Efficient capital allocation and management

Key highlights

No capital Infusion since 2008

Zero debt Company

Robust internal accruals

to support growth prospects

Communities

Material issues

- CSR and Community

- Financial Inclusion

Strategic Objective

- Sustainable growth with value creation

Focus areas

- Financial Inclusion

- Promoting Education

- Supporting Healthcare

- Environment

- Women Empowerment

Key highlights

110k+

CSR beneficiaries

` 226.2 mn

CSR spend in FY23

Key Performance Indicators

Driving growth

nurturing trust

With a strong focus on operational excellence, stakeholder value creation and building trust, we have not only thrived in a dynamic market but also emerged as a catalyst for positive change. Our relentless pursuit of excellence has positioned us as a leader, setting new standards and pushing boundaries in the insurance industry.

Read more

Our Value Creation Model

Strengthening the Core

Financial

Input

`10.01 bn

Equity share capital

`119.24 bn

Reserves and Surplus

Output

`673 bn

GWP

`130 bn

Net Worth

`460 bn

IEV

`17 bn

Profit After Tax

`51 bn

VoNB

`2.50 bn

Dividend paid

13.97%

ROE

30%

VoNB margin

Manufactured

Input

992

Number of offices

39,000+

Number of partner branches

`300.8 mn

Spend on office improvements and infrastructure

Output

2.20 mn

Number of policies issued

20.63 mn

Lives covered

85.52%

(13th Month) Persistency ratio

Intellectual

Input

`226.9 mn

Spend in technology

`115.6 mn

Spending in software

Output

5

New products launched

94%

Renewal premium collection through digital mode

99.3%

Individual policies sourced digitally

380

Robotic Process Automation

294

E-training modules, courses and quizzes

45%

Automated Underwriting

Human

Input

20,787

Number of employees

`171.74 mn

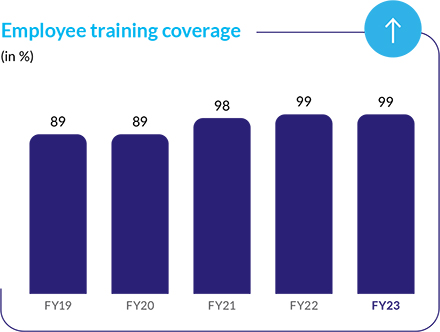

Spending on employee training

Employee engagement initiatives

Output

`34 mn

Revenue generated per employee*

Diversity

19.04%

women employees

49.3 hours

Average number of training hours per employee

5 years 1 months

Average number of years spent by an employee in the Company

738

GEM winners

Social and Relationship

Input

39%

Semiurban and rural branches

36

Number of CSR partners

`226.2 mn

CSR spends

Output

59

Net Promoter Score

110k+

Number of beneficiaries from CSR

7,00,344

Number of new policies issued in rural areas Premium: (`45 bn)

10,99,727

No. of new lives covered in social sectors

Natural

Input

Implementation of ESG framework

Waste management initiatives (E-waste, Paper)

Output

86.7 tCO2e

Scope 1 Emission

4,902.2 tCO2e

Scope 2 Emission:

1,850 kgs

E-waste recycled/disposed in environment-friendly manner

19,000+

No. of plants maintained

240 kgs

Paper waste reused

Governance

Resolute leadershipfor excellence

At SBI Life, we believe that true empowerment stems from the synergy of trust and responsible governance. Driven by our overarching objective to empower lives and create a meaningful world for our stakeholders, we embrace a governance framework built on integrity, excellence, and ethical practices.

Read moreRisk management

Managing riskswith prudence

At SBI Life, effective risk management is integral to achieving our strategic, business, and operational objectives. Our robust risk management framework, aligned with enterprise risk management (ERM) principles, ensures the identification, assessment and mitigation of risks. This framework is supported by risk appetite statements, integrating risk management with our strategic goals and overall risk appetite.

Read more