The evolving landscape

Changing regulations, customer preferences, and their material impact on financial performance are driving incorporation of ESG as a key factor in decisionmaking for organisations and investors alike. The Banking sector, being the custodian of the world's economies, will play a central role in ESG development and holds the key to systemic transformation required to achieve net-zero emissions. Already, lending decisions at Banks are becoming responsive to the ESG criteria. Additionally, Banks are incorporating ESG considerations into their risk management practices, including climate scenario analysis and climaterelated stress testing. Financial products with ESG element, such as green bonds, social bonds, etc. are being curated to satisfy the increasing demand for sustainable investment options.

As per a recent report by the World Bank, green bonds have raised USD 2.5 trillion globally until January 2023. During the same month, India launched the first green bond to raise about USD 2 billion for projects that contribute to climate change mitigation, adaptation, environmental protection, resource and biodiversity conservation, and netzero objectives. As per a study by the International Energy Agency, as quoted in the Reserve Bank of India’s Report on Currency and Finance, 2022-2023, to reach net-zero emissions by 2070, India would need USD 160 billion per year on average between now and 2030. The evident financing gap presents a compelling case for India’s financial sector to gear up its efforts in mobilising substantial funds and implementing sustainable financing solutions to support the country's ambitious decarbonisation goals.

While the RBI had been taking incremental actions towards aligning Banks and their lending decisions towards sustainable development for over a decade, it has demonstrated a distinct focus on climate-related issues in the past year. In July 2022, the RBI released its seminal “Discussion Paper on Climate Risk and Sustainable Finance” providing broad guidance. In January 2023, the RBI issued sovereign green bonds to mobilise resources for the Government for green infrastructural investments. In April 2023, the framework for mobilising green deposits by regulated entities has been released by the RBI with a view to fostering and developing green finance ecosystem in the country. In May 2023, its ‘Report on Currency and Finance’ uncovered the possible implications of climate change for the Indian economy and in preparing for the future – including climate stress tests to assess the banking sector’s vulnerability to climate risks. It is also expected to introduce a disclosure framework on climaterelated financial risks, along with guidance on climate scenario analysis and stress testing in the near future. The Securities and Exchange Board of India (SEBI) is also accelerating for the ESG transition in India. Moving forward from mandating ESG disclosures on quantifiable metrics for the nine principles of National Guidelines on Responsible Business Conduct for top 1000 companies in India FY23 onwards, it has now also announced mandatory assurance of select ESG disclosures for the top 150 companies starting in FY24 which shall be gradually extended to the top 1000 listed entities by FY27. It has also provisioned for ESG ratings based on these assured disclosures.

Our ESG strategy

The evolving landscape of ESG integration in the Banking sector therefore necessitates a holistic approach that encompasses ESG aligned decision-making not only for our internal operational practices, but also extending beyond onto our external financing activities. In context of the latter, we are building our systems to navigate challenges and anticipate disruptions that may manifest through this evolution in the coming decade. This makes it crucial for us to embrace transformation in operations and innovation in product development to drive the transition towards a more resilient, socially responsible and environmentally conscious economy. The demand for new solutions that catalyse and accelerate the transition to a new economy presents an opportunity for us to play a role that is more impactful, and direct than ever before. The trinity of innovation, technology and partnerships offers a tremendous opportunity for us to create new markets, products, and business models that would help build financial strength.

We are developing a comprehensive framework to support the integration of new ESG policies – including thorough evaluation of environmental, social and governance risks as a part of our overall credit appraisal and approval process, setting specific goals and targets for supporting sustainable financing initiatives, aligning with evolving ESG regulations and guidelines. Separately, we are also firming up an internal strategy around conducting climate risk assessments and tracking our financed emissions. We are also engaging with our corporate borrowers to understand their current ESG strategy and longterm climate transition plans, with a view to tailor our corporate loan portfolio towards climate-sensitive financing.

In terms of managing our internal operational practices, capturing ESG performance data remains one of our highest priorities and yet, a formidable challenge. The challenge is integral to distributed nature of our operations and is further convoluted with the volume of data and the variance in formats of data monitoring across our operations. We are continuously working towards bringing the relevant stakeholders together to communicate ESG requirements and revise existing data collection processes - where required to progressively enhance the completeness and accuracy of data. Our unrelenting efforts in this direction have enabled us to continuously further our transparency and disclosure practices. We continue to align our report with multiple frameworks - such as the GRI, IR, and SASB, and get the key ESG performance matrix externally assured. This year, we have progressed further and are disclosing the full suite of applicable BRSR disclosure requirements. We are also exploring data availability and methodologies for reporting on Task Force for Climate Related Financial Disclosures (TCFD) and Task Force on Nature-related Financial Disclosures (TNFD).

Two years ago, we strategically pledged to become carbon neutral by FY32. Over these two years, we have worked extensively to formulate and implement a framework that will keep us on the path towards this goal, while we continue to expand our operations. We continue to invest in a broad range of technological solutions and operational measures to reduce energy consumption at our operating locations including renewable energy and energy efficiency projects to lower our carbon footprint. Our pursuit of digitalisation, IT, IoT on one hand and ESG on the other hand has highlighted several areas of simultaneous progress; and we shall continue to leverage such opportunities by investing in IT capabilities and IT-enabled solutions. Upgradation of our data architecture will continue to complement evolution of our data governance practices and data collection strategy.

Underpinning all our ESG efforts is our resolve to manage expectations and respond to concerns of our stakeholders. Our people practices are based on principles of respect for human rights, employee wellbeing, inclusivity, fairness, and continuous improvement. For our customers, we strive to build longterm relationships based on trust, proving seamless service management journeys, offering a responsible suite of financial products and services, and safeguarding the confidentiality and protection of their information. Our curated community development initiatives aim to foster resilience, contribute to nation-building, and empower local communities through collaborative partnerships and targeted programs. By enforcing responsible vendor management practices, we ensure the sustainability values resonate with our suppliers and partners.

Our approach

Our ESG strategy encompasses people, customers, lending, and governance for long-term value creation for all stakeholders. Effective corporate governance acts as a binding force that integrates and supports our organisational ESG efforts by providing formalised processes, and structures that guide our decision-making and accountability to ensure successful integration of both internal and external ESG initiatives within the organisation. Our ESG initiatives are overseen by the CSR & ESG Committee of the Board. A separate ESG apex council at the management level, chaired by the Group Head for ESG & CSR and comprising senior members from various functions, reports to the CSR & ESG Committee and provides regular updates to the Board for annual review. This Committee is further supported by ESG Working Groups including the Environment Working Group which oversees the environmental impact from our operations; the Social and Governance Working Group which works on workplace policies and governance initiatives; and the Product Responsibility Working Group which looks at ESG risks (including climate risks) in the existing portfolio and ESGlinked opportunities.

We are in the process of setting out specific and measurable targets aligned with our business operations and portfolio to track and evaluate our progress, and report on the same to the CSR and ESG Committee of the Board through thorough consultation with ESG Council and Working Groups. We also intend to accelerate the scale and pace of delivering value by using collaboration as a mechanism to effectively foster strategic partnerships with solution providers, civil societies, government agencies that would help us bring together capabilities and resources to achieve our ESG objectives.

Sustainable finance

Sustainable finance is an organic continuum of our ESG strategy. The ESG strategy has set the foundation for the Bank to channel its resources towards sustainable projects. With ESG gaining momentum as a key factor in business decision making, the Bank is leveraging sustainable finance as one of its key ESG strategies in the form of enhanced environmental and social due diligence in lending and investment decisions thematic investing, ESG engagement and sustainable finance frameworks. Directing capital towards sustainable projects allows us to integrate ESG as the fundamental determinant in our core lending strategy, and generate a positive impact through our business model.

Being one of the key players in the banking industry, we recognize our role in facilitating the transition to a low-carbon economy. With our panIndia presence and strong customer relationships, we aim to drive positive change by promoting environmentally friendly technologies and financing sustainable infrastructure projects. We actively support the financing and investment in environmentallyfriendly technologies and low-carbon infrastructure projects, leveraging our product offerings and financial expertise to assist our customers and clients in transitioning to a sustainable, low-carbon economy.

The Bank has identified its products as one of the foremost business focus areas wherein ESG risks, and opportunities will be considered for improvement in systems and processes taking into account the expectations from various stakeholders including investors and regulators. The Bank is pursuing this through three thematic areas including ESG integration in products, sustainable finance and portfolio emissions. As the next step, long-term targets to strive to contribute to a more sustainable future are being set.

ESG integration in products

We have adopted a four-dimensional approach for steadily incorporating ESG factors into the design, development, and management of our products.

ESG & Climate Change Assessment framework:

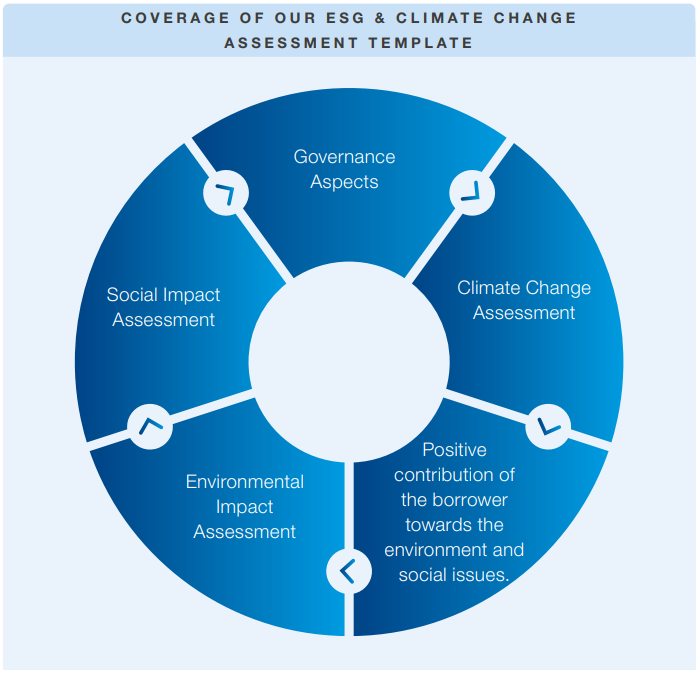

In FY23, the Bank adopted an enhanced and more comprehensive “ESG & Climate Change Assessment” framework, as a part of the overall credit assessment for its wholesale corporate borrowers. The framework has replaced the erstwhile “SEMS Framework” and is applicable for all borrowers where the Bank’s direct funded and non-funded credit exposure to the borrower exceeds `100 Crore.

As per the framework, a detailed template that captures the various aspects of ESG compliance and climate change risks/mitigants in relation to the borrower, and their business operations as a whole, is a mandatory part of the credit assessment and is included in the Credit Appetite Memorandum (CAM) for wholesale borrowers. The template assesses the various ESG & Climate Change Risks associated with the borrower’s operations and mitigation measures/controls for the same.

Environmental Impact Assessment

- Adverse impact that the operations of the borrower could have on environment and the steps taken by the borrower to mitigate such effects

- These include potential Air/Water pollution and greenhouse gas emission levels, hazardous waste generation, radiation levels etc. as applicable

- Adherence to statutory norms with respect to environmental pollution and possession of various licenses/certificates/permits needed from the requisite statutory bodies/agencies

- Systems and processes in place to mitigate risks arising out of various potential adverse environmental impacts

Social Impact Assessment

- Land acquisition, payment of fair compensation, resettlement & rehabilitation

- Adherence to statutory norms with regard to labour law, workmen compensation, payment of worker dues, etc.

- Policies in place to counter inappropriate labour practices (employment of child/forced labour), anti-sexual harassment policies and human rights policies etc.

Governance Aspects

- Good governance practices to combat bribery, corruption and money laundering

- Executive compensation

- Adequate representation of shareholders in management

- Composition and diversity of Board of Directors

Climate Change Assessment

- Potential impact of climate change on borrower’s operations and vice versa

- Assessment of physical & transition risk

Positive contribution of the borrower towards the environment and social issues.

- Efforts made towards conservation of biodiversity and ecological balance

- Community engagement

0 +

Corporate borrowers covered

under “ESG & Climate Change Assessment”

`0.0 Cr

funded outstanding to these

borrowers as on March 31st, 2023

Additional diligence for large project financing transactions

For specialised, long-term project financing, in addition to the above assessment which is carried out at borrower level in all CAMs, Lenders’ Independent Engineer (LIE) assesses various environmental and social issues related to the transaction and the various identified risks and suggested mitigation measures are captured in a LIE Report. As a pre-disbursement compliance, implementation of the necessary mitigation measures is required and are also monitored on an ongoing basis during the implementation phase of the project and corrective action is taken in case of any adverse developments.

Client engagement

As the largest private sector Indian Bank, our role is to create awareness amongst our borrowers, thereby encouraging them to measure and disclose their footprint. This would eventually reflect in our Scope 3 emissions and help us move towards a net-zero portfolio commitment. We understand that there are opportunities in transitioning to a netzero economy, but the ecosystem (in the country) needs to be developed to take up such opportunities. The Bank has been engaging with its large corporate customers specifically those with businesses in “hard to abate” industries such as Oil & Gas, cement, steel, power, auto, and mining. The purpose of these engagements is to identify current ESG & Climate change related focus areas/practices and to identify best practices and emerging initiatives being taken by industry players on ESG and climate risk related issues including, but not limited to:

- Short term emission reduction targets and long-term net-zero goals Practices with respect to hazardous/polluting waste management

- ESG & climate related disclosures

- Supply chain decarbonisation

- Policies and practices with respect to gender diversity/inclusion

The Bank has been sharing such best practices in wider client engagements with other borrowers in the same segments. ESG compliance and the impact of climate change has also become one of the areas of discussion in our regular customer calls/meetings with the Customers. The discussions are expected to continue to take place with different borrowers and best ractices/learnings from the same would be documented.

Inclusion of terms & conditions related to ESG compliance in facility documentation

As part of the Bank’s standard facility documentation, an addendum schedule has now been included which comprises representations/warranties/covenants agreed to, by the borrower on various ESG related issues. This schedule is included in all standard sanction letters

Sustainable Finance Framework

It is our endeavour to enhance our portfolio from a climate and ESG perspective. The Bank is in the process of developing a “Sustainable Financing Criteria” Framework (“the Framework”) with the objective of identifying facilities in its credit portfolio where financing has been provided to borrowers in identified industries, qualifying as “sustainable lending”. Credit facilities granted towards such end uses in the specified industries shall be classified as either “green” or “social” facilities. The Bank is developing the Framework with the objective of assessing and ultimately enhancing its commitment towards sustainable lending in various industry segments.

The Framework is being developed using Bond Principles (developed by the International Capital Markets Association - ICMA) and Loan Principles (developed by the Loan Market Association - LMA) as the basis for identification of “sustainable finance segments”. Some of the key industry segments which have been identified thus far as “sustainable segments” include:

- Renewable energy – Solar and Wind power generation

- Hydroelectric power generation

- Agriculture and Allied Businesses

- Biomass and other non-conventional energy sources

- Sustainable/affordable Infrastructure

- Impact NBFCs

The Bank is in the process of obtaining a third-party certification of the methodology behind the framework and the framework itself. Once this is in place, suitable disclosures would be made in the public domain. Our plan to monitor our sustainable finance portfolio will enable us to identify and utilise climate transition value creation opportunities.

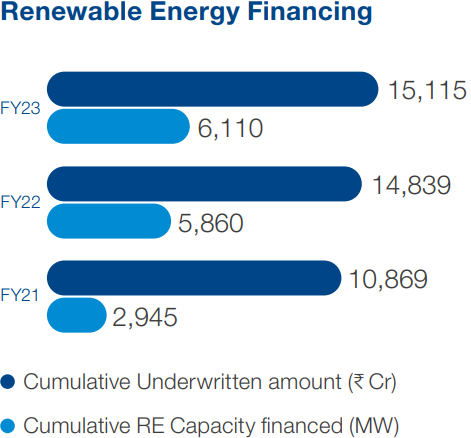

Our financed renewable energy (solar and wind) capacity has more than doubled in the past 3 years, and we anticipate financing to renewables as well as other green projects to further accelerate in the coming years. So far, we have underwritten loans of `15,115 Crore for a cumulative capacity of 6,110 MW. Also, with increased focus on energy transition projects we sanctioned credit limits of `160 Crore towards deployment of electric buses.

Managing our portfolio emissions

As a progressive financial service company, we embrace our responsibility to incorporate environmental considerations into our investment decisions. Through our investments, we look forward to driving the transition towards a sustainable, low-carbon economy while mitigating the risk of stranded investments. This includes firming up a strategy to integrate environmental risks, including those stemming from climate change, into our underwriting and portfolio screening processes in the long term.

Our lending procedures are guided by borrower and market demand, but our credit exposure is well-diversified, with no single industry having a high concentration. As a result, our credit exposure to ecologically/socially sensitive industry sectors has minimal negative consequences.

Disclosure of our own portfolio emissions remains dependent upon emission data disclosures from our borrowers. Although, we acknowledge the challenges involved, we remain steadfast to working with our borrowers to build their capacity for the same. Simultaneously, despite the foreseeable challenges, we also intend to use our influence to encourage our borrowers to commit to net-zero.

Less than 1% of the total exposure comes from fossil fuels (coal and lignite) and their extraction/mining.

Our impact story

Fuelling the Future

`0.0 Cr

Successfully underwritten project term loan facility

The Bank has successfully underwritten project term loan facility amounting to C2,143 Crore for financing development of City Gas Distribution (CGD) network being implemented by Torrent Gas Jaipur Private Limited. Jaipur CGD network consists of 132 CNG (Compressed Natural Gas) stations, 5.28 Lakh household PNG (Piped Natural Gas) connections and 8,423 inch-km of natural gas pipelines. CGD financing aids the energy transitions towards greener fuel reducing the country’s oil dependence and supports Governments’ initiatives to make the country a Gas economy.

The Bank is the advisor for Mahanagar Gas Limited for acquisition of Unison Enviro Private Limited a (subsidiary of Ashoka Buildcon Limited), which is developing CGD network in three geographical areas. Also, the Bank is the lead arranger for raising funds from public through IPO listing for IRM Energy Private Limited.

In alternative fuel space, the Bank is evaluating multiple proposals for financing projects involved in production of Compressed Biogas (CBG) projects and Ethanol which reduces the carbon emissions substituting the conventional fuels like oil & gas.